As you begin to collect your 2021 income tax information and prepare to file a return, are you:

- Realizing that your tax situation may be different from previous years?

- Interested in learning about a way to support your community in a tax-wise manner?

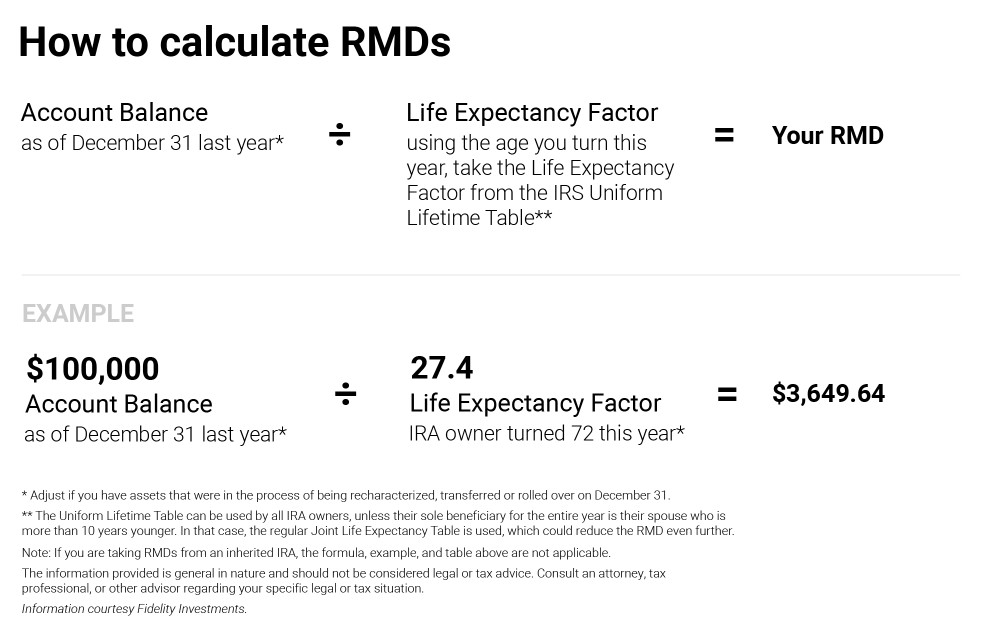

Tax law changes could impact your strategy as you are filing your taxes. The SECURE Act, passed in January 2020, increased the beginning age for Required Minimum Distributions (RMDs) from Individual Retirement Accounts (IRAs) and other qualified retirement plans from 70 ½ to 72 for individuals that had not reached age 70 ½ by December 31, 2019. If you, or someone you know, reached 70 ½ years of age by December 31, 2019, you must withdraw a portion of your IRA each year based upon your age. The CARES Act waived RMDs for 2020, but that suspension no longer applies. RMDs are now mandated and you must pay income tax on the portion you withdraw. Failure to withdraw your RMD will result in stiff penalties.

New for 2022 are updated IRS life expectancy tables – used to determine RMDs. The first change in the tables since 2002, this update should result in a slight reduction in your RMDs, meaning less money you’ll need to withdraw, subject to income taxes, from your retirement accounts.

The SECURE Act also established new rules for IRA beneficiaries. Known as the ‘10-year-rule,’ most beneficiaries of an IRA must have their inherited account distributed by December 31 of the 10-year anniversary of the original owner's death. Beneficiaries of IRAs before January 1, 2020, are grandfathered into the old rules.

Often subject to high estate and income taxes, an IRA left to your heirs may result in fewer dollars for them. The more you can save on your tax bill, the more your heirs will inherit from you. Additionally, you can name the Tidewater Jewish Foundation as the beneficiary of your IRA plan. Use this asset to endow your gift and leave other assets subject to lower taxes to your heirs. At the same time, future Jewish generations in Tidewater will enjoy the benefits of your generosity.

For more information, contact Naomi Limor Sedek, Tidewater Jewish Foundation President and CEO, at 757-965-6109 or nsedek@ujft.org.

This information is not intended as tax, legal, or financial advice. Gift results may vary. Consult your personal financial advisor for information specific to your situation.